Colorado HVAC Rebates 2026

How Much Can You Save on a Heat Pump?

Colorado homeowners save $7,750 to $15,750 by stacking Xcel, HEAR, and state tax credit programs. We handle every application and guarantee the amount on your invoice.

Updated February 9, 2026•By Editorial Staff

12,000+ installations completed

Short version: The federal 25C credit ended December 2025. What's left actually pays more for most Colorado homeowners. Xcel alone is $2,250/ton. HEAR adds up to $14,000 if you're under 150% AMI. State credit is $1,000. All applied as upfront invoice discounts - no reimbursement checks, no tax forms to file.

Top Rebate

$2,250/ton

Max Stack

$20,250

Programs

4 Active

Paperwork

We Handle It

Blue can make mistakes. Check important info.

2026 Update

What Colorado Rebates Are Available Right Now?

Statewide Programs, Plus Local Utility Rebates

Xcel Energy offers $2,250/ton for cold climate heat pumps. The Colorado state tax credit adds $1,000. And HEAR, the federal Home Electrification and Appliance Rebate now administered statewide by the Colorado Energy Office, covers up to $14,000 for qualifying households. Combined on a 3-ton system: $7,750 to $15,750 depending on income. Not on Xcel? United Power, Longmont Power, and Boulder County EnergySmart have their own programs that stack with HEAR and the state credit.

What Changed for 2026

The federal 25C tax credit ended December 31, 2025. For most Colorado homeowners, the remaining programs now exceed what the federal credit provided. Power Ahead, backed by $273 million in DRCOG regional funding, is expected to add another layer when it launches mid-2026.

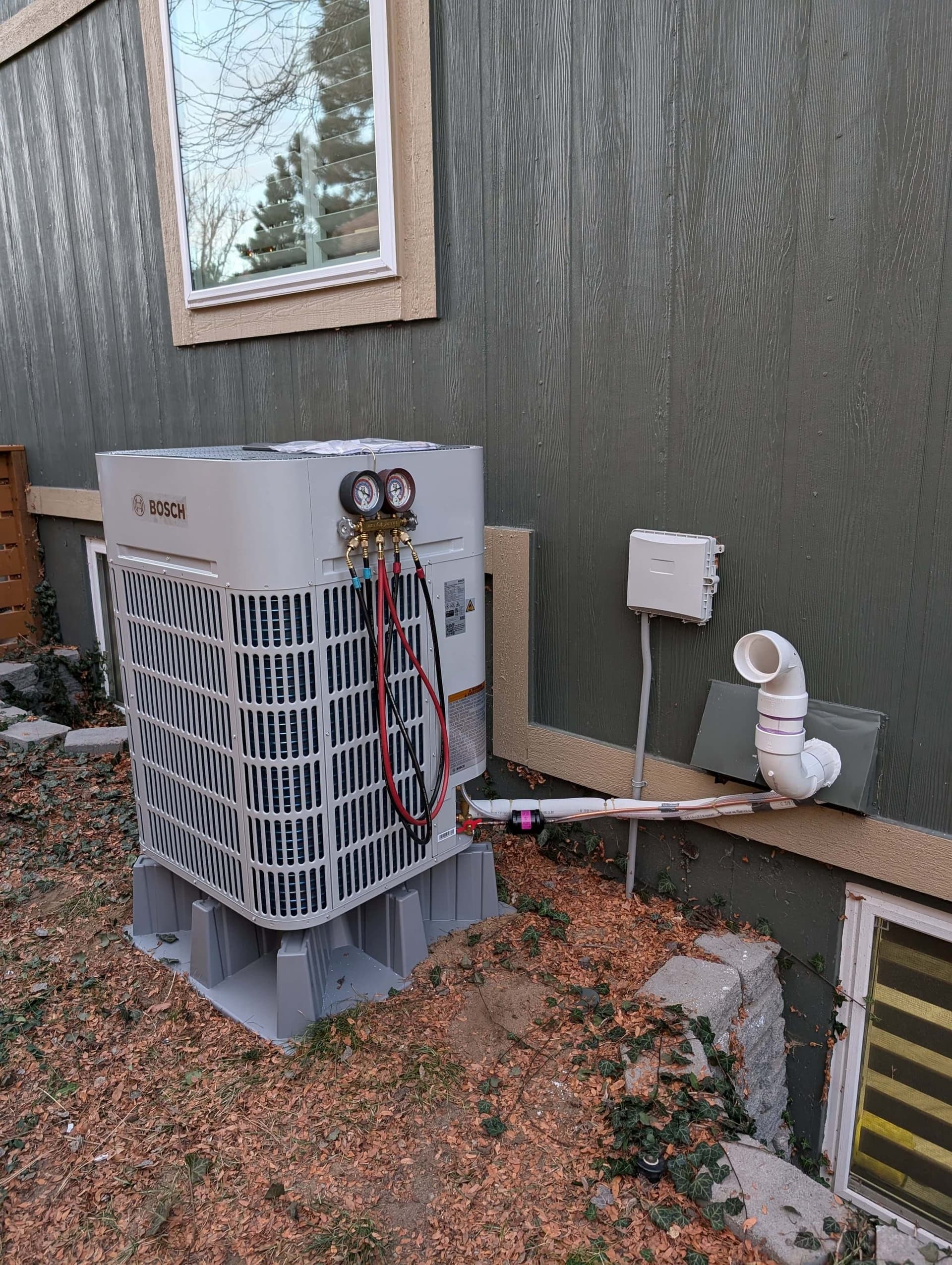

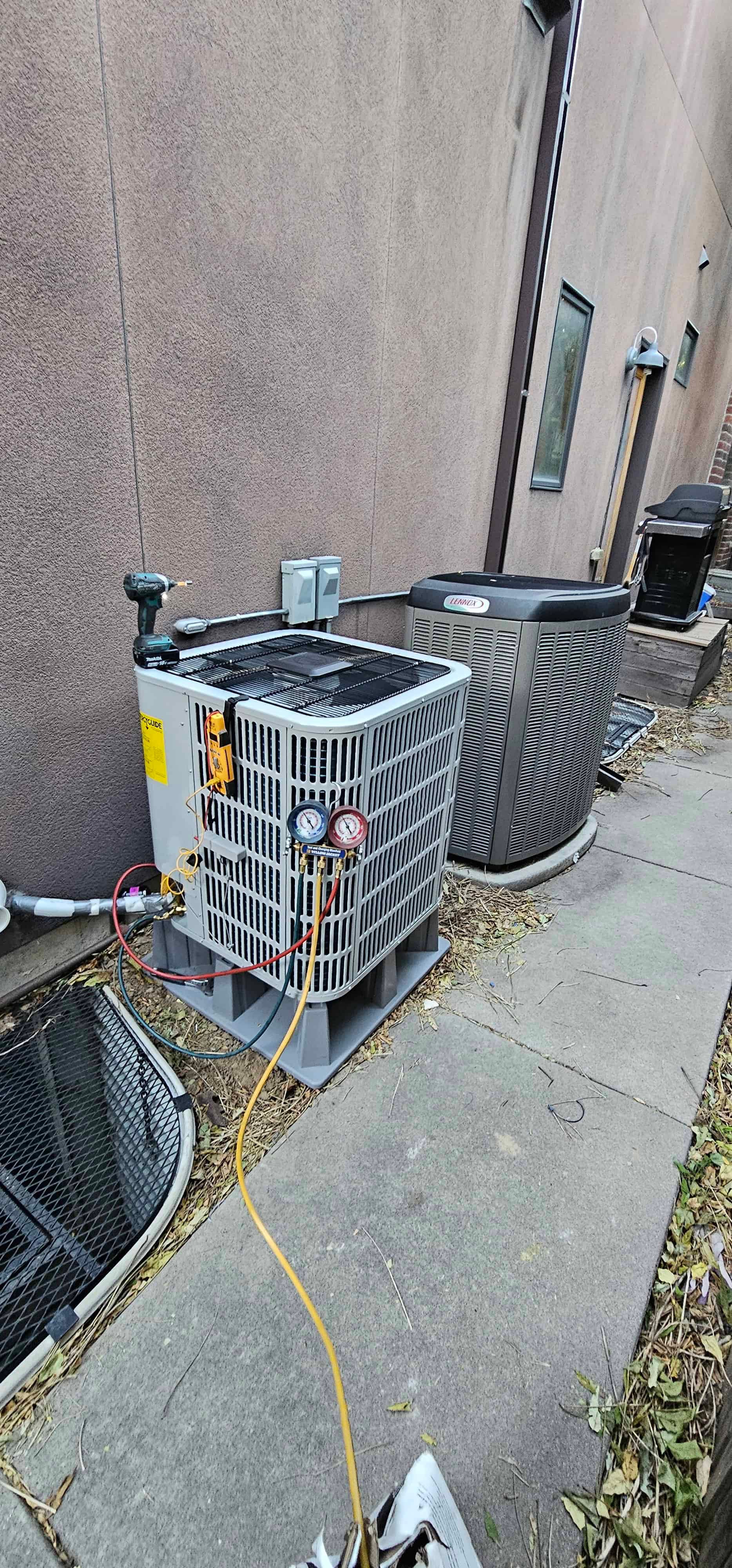

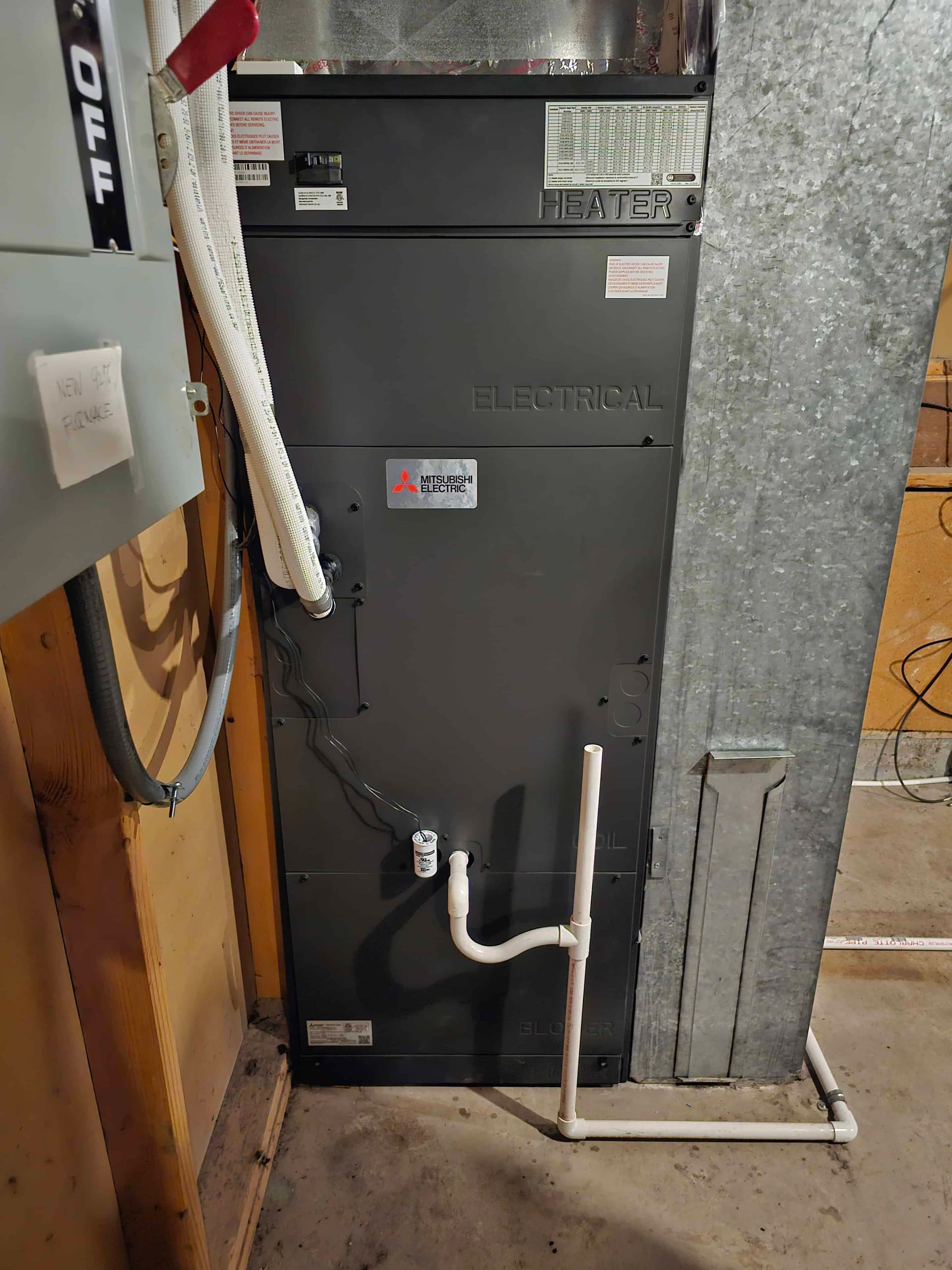

Heat Pumps Only

No furnace or AC rebates exist in 2026. Every active program is limited to heat pumps, heat pump water heaters, and electrification upgrades (panels, insulation, wiring). That's the main reason Colorado homeowners are switching. A cold climate heat pump replaces both your furnace and AC in one system, and it's the only equipment category with active incentives.

Find Your Savings in Two Clicks

Answer two quick questions to see your estimated rebate total

RebateStacking

How Your Rebates Stack Up

Real savings scenarios for a 3-ton cold climate heat pump in Denver. Compare all income levels at a glance.

Any Income

All Xcel customers, no income requirement.

Up to Total Savings

$7,750

Income-Qualified

Under 150% AMI (~$168K for household of 2).

Up to Total Savings

$15,750

Lower Income

Under 80% AMI (~$84K for household of 2).

Up to Total Savings

$15,750

Based on 3-ton cold climate heat pump. Xcel amounts assume standard rebate tier. HEAR amounts depend on income level and household size. State credit is $1,000 for heat pumps.

All Programs

Rebate Program Comparison

Every active, upcoming, and ended program. Sort by column, search by name, or filter by status.

| Program | Max Rebate | Income Req. | Stackable | Status |

|---|---|---|---|---|

Xcel Energy (cold climate) Per heating ton at 5°F | $2,250/ton | Any Income | Stackable | Active |

Xcel Energy (standard ASHP) Per cooling ton at 95°F | $900/ton | Any Income | Stackable | Active |

HEAR (80-150% AMI) Up to 50% of project cost | $8,000 | Income-Based | Stackable | Active |

HEAR (<80% AMI) Up to 100% of project cost | $8,000 | Income-Based | Stackable | Active |

| $1,000 | Any Income | Stackable | Active | |

United Power Ducted >2 ton. Brighton, Erie, Firestone area. | $2,500 | Any Income | Stackable | Active |

Longmont / Efficiency Works Per unit + $2,000 bundling bonus | $2,000 | Any Income | Stackable | Active |

EnergySmart (Boulder County) 70% of project cost cap | Varies | Any Income | Stackable | Active |

| TBD | Any Income | Stackable | Mid 2026 | |

| - | - | - | Ended May 2025 | |

| - | - | - | Ended Dec 2025 |

Income-Based Rebates

Do You Qualify for HEAR?

HEAR rebates are income-based. Enter your household size and county to check eligibility for up to $14,000 in additional rebates.

Browse Programs

Available Rebate Programs

Not on Xcel?

We also process rebates for other Front Range utilities. Each stacks with HEAR and the Colorado state tax credit.

Our Process

How We Handle Your Rebates

- 1Estimate. We identify every program you qualify for and calculate exact dollar amounts before you commit to anything.

- 2Invoice discount. Rebates are applied as upfront reductions on your invoice. You pay the after-rebate price at signing. No waiting for reimbursement checks.

- 3We submit everything. Xcel applications, HEAR income verification, and any other program paperwork. You don't file anything.

- 4State credit handled too. UniColorado claims the $1,000 Colorado tax credit on your behalf. It reduces your invoice directly. Nothing to do on your tax return.

Typical timeline: 1-2 weeks for HEAR income verification, same-day for Xcel pre-approval. Most customers have their final discounted price confirmed before equipment is ordered.

How It Works

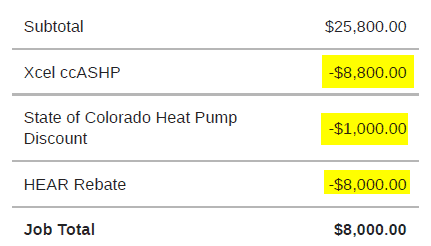

This Is What Your Invoice Looks Like

We don’t just install heat pumps. We maximize your savings. Every rebate shows up as a line-item discount before you pay.

Rebates applied as upfront discounts

Every eligible rebate is deducted directly on your invoice. You pay the reduced price at installation. No waiting for reimbursement checks.

We handle all the paperwork

Our team submits every application, gathers documentation, and follows up with program administrators. You sign, we do the rest.

Guaranteed amount or we cover it

If a rebate is denied after we quoted it, we absorb the difference. The discount on your invoice stands.

Proven Results

12,000+ Installations and Counting

“UniColorado stacked three rebate programs on our heat pump install and saved us over $15,000. They handled every piece of paperwork.”

Sarah M.

Denver, CO

“The rebate was applied right on the invoice. No waiting for checks. The whole process was transparent from the estimate through installation.”

James & Linda R.

Centennial, CO

“We didn’t think we qualified for HEAR but UniColorado ran the numbers. Turns out we saved $8,000 more than we expected.”

Mike T.

Littleton, CO

CommonQuestions

Rebate Questions

Get Rebate Updates

New programs launch throughout the year. Be the first to know when rebates change.

Check Your Rebate Eligibility

Free rebate analysis with every estimate