TL;DR

- The tax credit for heat pumps (25C) ended 12/31/2025

- The 30% residential solar tax credit (25D) ended 12/31/2025

- If you completed an installation in 2025, you can still claim the credit on your 2025 tax return.

In July 2025, a new federal law nicknamed the "Big Beautiful Bill" was signed into effect, bringing big changes to home energy incentives. Officially called the One Big Beautiful Bill Act (OBBBA), this ends key federal tax credits for residential HVAC upgrades and solar installations at the end of 2025.

These credits have now expired. Below we break down what changed and how it impacts homeowners looking to install a heat pump or solar panels going forward.

End of Federal HVAC Tax Credit (Section 25C)

The Residential Energy Efficient Home Improvement Tax Credit (Section 25C) which many homeowners use for HVAC improvements like heat pumps, efficient furnaces, insulation, and windows is being sunset earlier than expected.

This credit currently covers 30% of the cost of qualifying home upgrades (with caps up to $3,200 per year). Under the Inflation Reduction Act (IRA) of 2022, 25C was originally available through 2032. The new bill cuts that timeline: any improvements placed in service after December 31, 2025 won't qualify for the federal 25C credit. In practical terms, homeowners have until the end of 2025 to install eligible HVAC upgrades (such as high-efficiency heat pumps) if they want to claim up to the $2,000 heat pump tax credit portion.

TL;DR: The 25C Federal tax credit, most commonly used for heat pumps and heat pump water heaters, will be gone at the end of 2025.

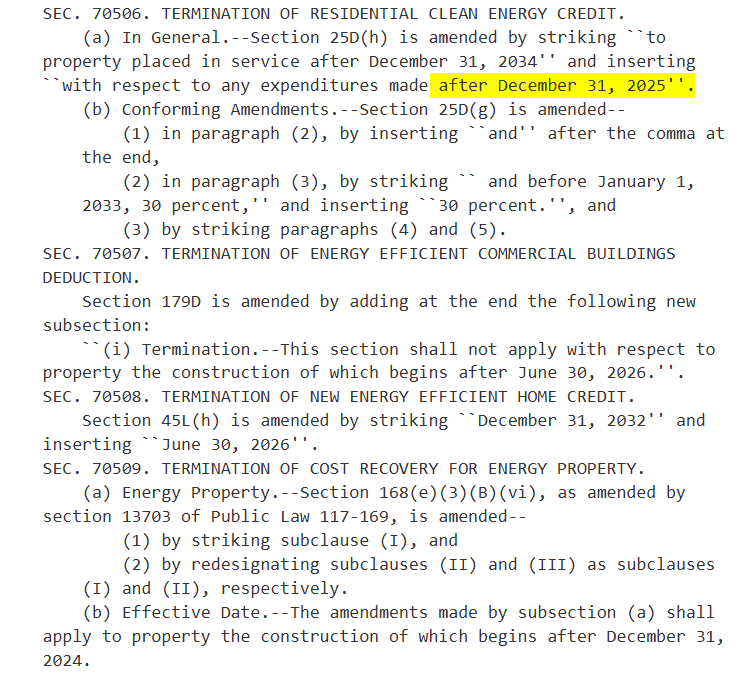

End of 30% Residential Solar Tax Credit (Section 25D)

Home solar incentives are seeing a similar rollback. The Residential Clean Energy Credit (Section 25D), widely known as the 30% federal solar tax credit for installing solar panels (and home batteries, solar water heaters, etc.) will expire at the end of 2025, much earlier than planned. This credit has been a cornerstone of solar affordability, effectively giving homeowners a dollar-for-dollar tax reduction equal to 30% of their solar installation cost. Under previous law (the IRA), the 30% solar credit was set to continue into the 2030s (stepping down after 2032). The Big Beautiful Bill accelerated its end by nearly a decade. Now, systems installed after December 31, 2025 will not receive any federal solar tax credit.

TL;DR: The 25D Federal tax credit for residential solar will be gone at the end of 2025.

Before vs. After: Tax Credit Timeline Comparison

Both credits that were created or expanded by the IRA ended on an identical schedule: no new residential credits after December 31, 2025 for solar or efficient HVAC upgrades. The deadline has passed. Homeowners who completed installations in 2025 can still claim these credits when filing their 2025 taxes.

Installations completed in 2026 or later do not qualify for these federal credits, barring new legislation.

What This Means for Homeowners

Higher upfront costs: Without federal tax credits, the cost of home energy upgrades has increased. A $30,000 solar system that previously cost about $21,000 after the 30% credit now costs the full $30,000. A $10,000 heat pump no longer benefits from the $2,000 credit. Homeowners need to budget for these higher net prices.

Reduced return on investment: Removing the credits means a longer payback period for solar and efficient HVAC systems. Although utility savings still help, homeowners may find the financial return less compelling without the early boost from federal incentives.

The deadline has passed: The federal credits expired December 31, 2025. Homeowners who completed installations in 2025 can still claim the credits on their 2025 tax returns. New installations in 2026 do not qualify.

Alternative incentives remain: State, city, and utility rebate programs are not affected by the federal changes. These can still offer meaningful savings. For example, Colorado provides heat pump rebates and state tax credits, and utilities often offer incentives for efficient systems. Homeowners should research local programs or speak with contractors to explore available options.

Market effects: The end of federal credits created a surge in demand in late 2025. Some contractors have responded with new financing or promotions to keep projects appealing. State and utility rebates remain available and continue to provide significant savings.

Bottom line: Federal tax credits ended after 2025. Projects completed before the deadline still qualify when filing 2025 taxes. Going forward, the decision to upgrade depends on state and utility incentives, HEAR rebates for income-qualified households, and long-term energy savings. Consulting with professional installers can help ensure your project delivers the best value.

Colorado's most experienced heat pump installer

While the federal tax credits have ended, state and utility rebates remain available. UniColorado has been designing and installing heat pump systems in Colorado for over a decade. Unlike many contractors who place rebate risks and waiting periods on homeowners, we immediately apply your Xcel rebate as an upfront discount, saving you money from day one.

With UniColorado, you get the confidence that comes from thousands of successful heat pump installations combined with upfront rebate savings applied directly to your invoice.