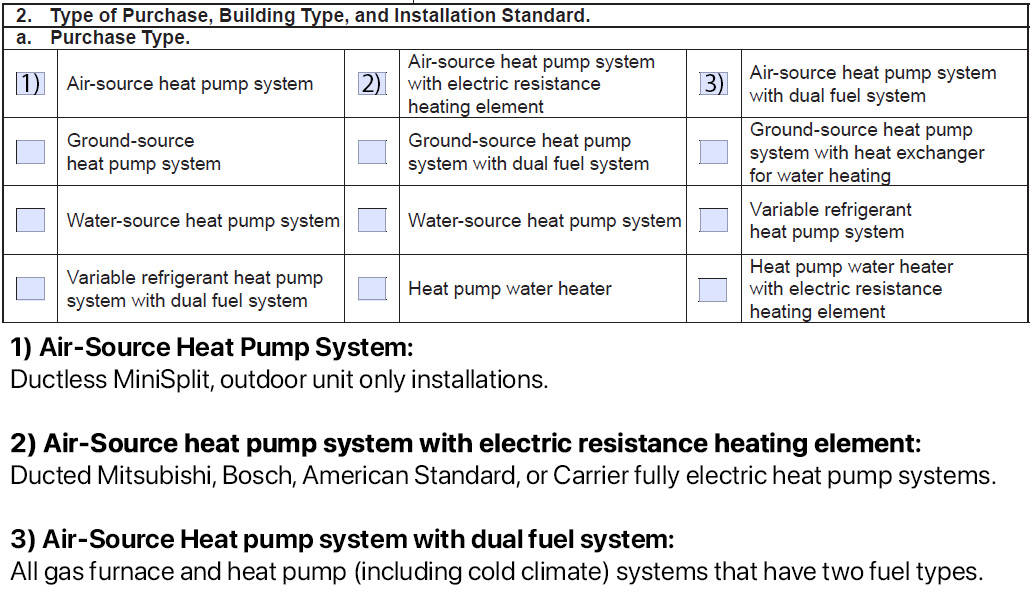

A Colorado State tax credit for heat pumps and heat pump water heaters is available for customers who placed equipment in service in 2023.

This guide applies to you if you meet the following criteria:

If you meet this criteria, please follow our guide below:

Disclaimer: Please consult a tax professional for advice on your individual tax situation. We are not responsible for any specific tax issues that may arise from our simplified guide.

Homeowners who did not purchase from UniColorado, please contact your installer.

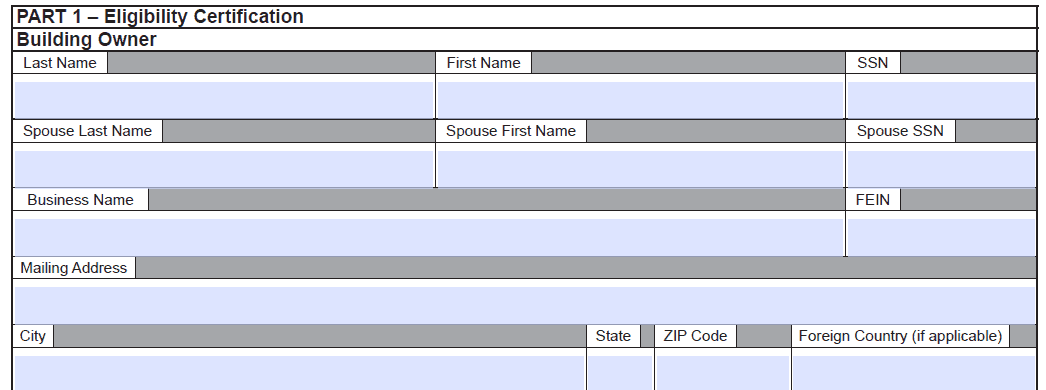

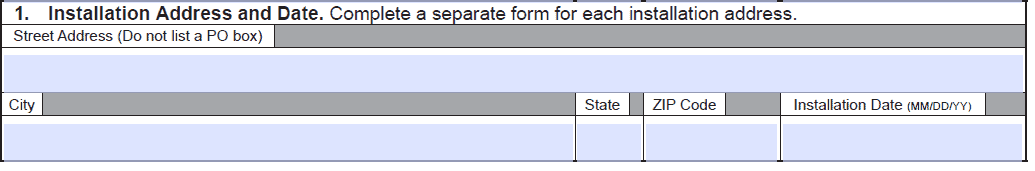

Fill out the form below to recieve a pre-filled DR1322 form from UniColorado.