This page walks through how to claim the federal heat pump tax credit for 2025, including the new QMID requirement, what documents you need, and exactly where everything goes on Form 5695 for heat pumps and heat pump water heater installations.

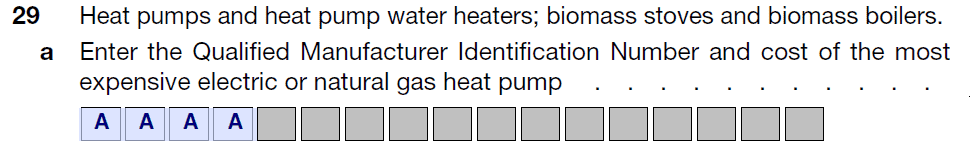

For heat pumps installed in 2025, the IRS requires a Qualified Manufacturer Identification Number (QMID) to be reported on Form 5695 for the federal energy efficient home improvement credit.

Eligible UniColorado customers will receive an email that includes their invoice, AHRI certificate, and QMID. The QMID provided can be used directly when filing taxes.

You still need a QMID to claim the credit. UniColorado has created a free public QMID directory available at:

Rebate Blue QMID Directory

Example:

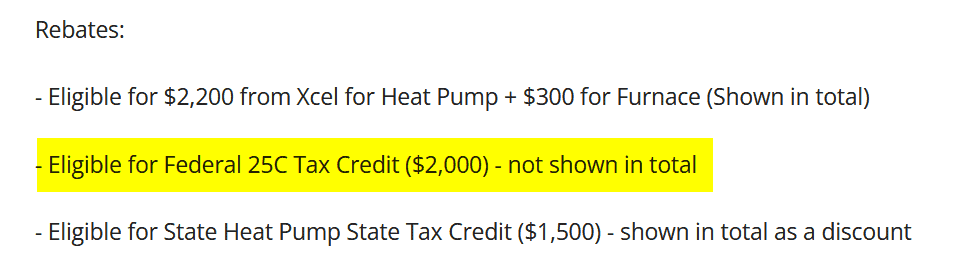

If your federal tax liability is $4,000 and you qualify for a $2,000 credit, your tax owed is reduced to $2,000.

Disclaimer: Please consult a tax professional for advice on your individual tax situation. We are not responsible for any specific tax issues that may arise from our simplified guide.

Electrical (Page 3, line 25) — only if you did a panel upgrade or added circuits specifically to enable the heat pump or heat pump water heater.

Heat pumps + heat pump water heaters (Page 4, line 29)

Important notes

Filing instructions

Additional information

Not tax advice. Always confirm eligibility and credit details using IRS Form 5695 and official IRS instructions.