On January 21, 2025, the incoming adminstration issued an executive order pausing federal grants and loans tied to the Inflation Reduction Act (IRA). This has raised questions about the future of key tax credits and rebate programs for energy efficiency (Source: Reuters). Here’s how this impacts Colorado homeowners and businesses.

The 25C Residential Energy Efficiency Tax Credit, which provides up to $3,200 for qualifying energy upgrades, including HVAC systems, is not impacted by the executive order. The order specifically targets grants and loans, not the $270 billion allocated for tax credits under the IRA (Source: SustainableViews). Colorado residents can claim this tax credit for eligible HVAC upgrades through 2025.

The High-Efficiency Electric Home Rebate (HEAR) and Home Energy Performance-Based Whole-House Rebates (HOMES) are expected to roll out in Colorado in 2025. Currently, the HEAR program is available to income-qualified households through the Colorado Weatherization Assistance Program, while the full statewide launch is scheduled for Spring 2025. The HOMES program is anticipated to launch mid-2025, providing rebates based on the overall energy savings achieved through home improvements

The Biden administration safeguarded funding for these rebate programs by obligating a significant portion of the IRA’s clean energy grants early. This action legally locks these funds, making it difficult for future administrations to rescind them. Colorado received its share of this funding (Source: Reuters).

The HEAR and HOMES rebate programs are on track for implementation in Colorado. Residents can rely on these rebates to reduce the cost of energy-efficient upgrades. Income-qualified households can already access some benefits, with broader availability coming soon.

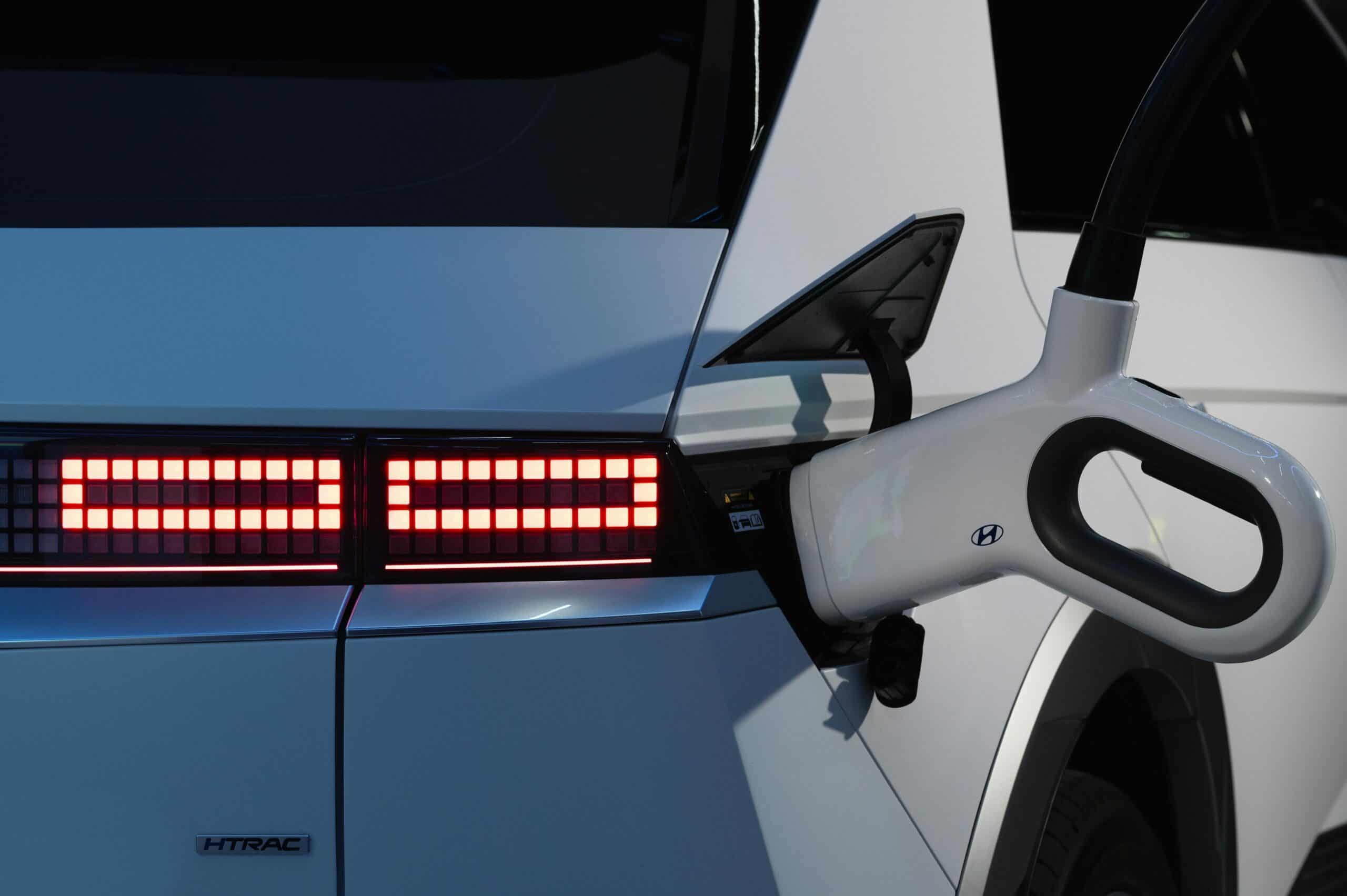

Electric Vehicle (EV) tax credits, which offer up to $7,500 for new EV purchases, are still available (Source: IRS EV Credit Guide). However, unlike HVAC-related tax credits and rebates, there is some uncertainty about the future of these credits. While the executive order does not directly impact them, ongoing discussions at the federal level could lead to revisions of EV incentives (Source: NYT).

The Electric Vehicle (EV) tax credit, like the 25C tax credit, is part of the tax code and funded through the Inflation Reduction Act (IRA). However, it is less secure for a few reasons. EV tax credits are often more visible and politically debated because they are tied to the push for electric cars and reducing carbon emissions. This makes them a frequent target in discussions about federal spending.

Unlike the 25C credit, which supports general home energy efficiency and is widely supported, EV tax credits sometimes face criticism for benefiting wealthier buyers or specific car companies. They are also closely linked to federal climate policies, which means they are often part of larger debates about clean energy priorities. If political priorities shift, EV tax credits are more likely to face changes.

That said, both the 25C and EV tax credits are protected by law, and any changes would require Congress to pass new legislation. While EV credits face more political scrutiny, they cannot simply be removed without significant legal and procedural steps.

The Inflation Reduction Act (IRA) allocated substantial funds for clean energy initiatives. Prior to leaving office, the Biden administration took steps to secure these funds by obligating approximately 84% of the clean energy grants through signed contracts between U.S. agencies and recipients. This action makes it legally challenging for subsequent administrations to retract or “claw back” these obligated funds.

However, not all IRA funds were obligated before the transition. Approximately $11 billion remained unobligated and thus potentially vulnerable to rescission or reallocation by the incoming administration. The ability to claw back unobligated IRA funds depends on several legal and procedural barriers. Many of these funds are tied to mandatory spending laws, which means they are automatically available unless Congress passes new legislation to cancel or change them. Funds that have already been allocated through signed contracts are legally binding, making it difficult to retract them without facing lawsuits. Even unobligated funds cannot simply be redirected by the executive branch, as their use is governed by congressional appropriation laws. This means clawing back funds is not only complex but would also likely require new legislation and significant legal justification.

The 25C Residential Energy Efficiency Tax Credit provides homeowners with a credit of up to 30% of the cost of qualified energy-efficient improvements, capped at $1,200 annually. This tax credit is established under the Internal Revenue Code and is available for improvements made through 2032.

As a tax credit codified into law, the 25C credit is not subject to clawback in the same manner as discretionary grant funds. Once a taxpayer qualifies for and claims the credit on their tax return, it becomes part of their tax record. To alter or eliminate this tax credit, new legislation would be required to amend the existing tax code provisions. Therefore, unless Congress enacts such changes, the 25C tax credit remains in effect and is not susceptible to rescission by executive action alone.

In summary, while obligated IRA funds are largely protected from clawback, unobligated funds may be at risk depending on administrative actions and legal constraints. The 25C tax credit, being a statutory tax provision, is secure unless modified through legislative processes.