- HeatingHeating Services

- Air ConditioningAir Conditioning Services

- Heat PumpHeat Pump Services

- ElectricalElectrical Services

- About

UniColorado Heating & Cooling is pleased to share the benefits of the 25C tax credit under the Inflation Reduction Act with our customers. This credit is a great opportunity for our customers who are considering investing in energy-efficient heating and cooling systems.

Eligibility Criteria for UniColorado customers:

Important Highlights of the Federal 25C Tax Credit:

Disclaimer: Please consult a tax professional for advice on your individual tax situation. We are not responsible for any specific tax issues that may arise from our simplified guide.

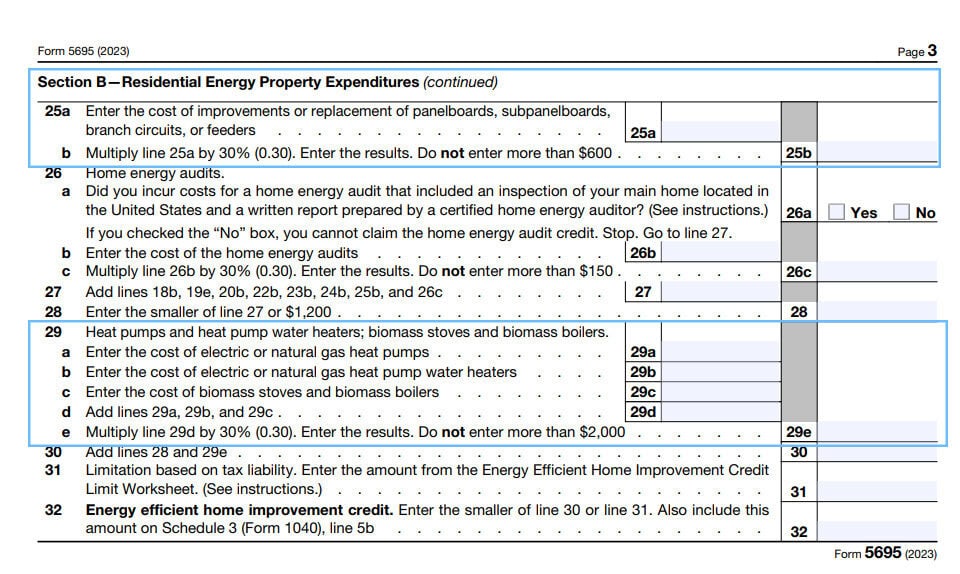

IRS Form 5695: Download & complete IRS Form 5695. Focus on Part Two: Energy Efficient Home Improvement Credit. This section is designed for the heat pump tax credit.

Integrating with Form 1040: When you file your taxes, include the calculated tax credit information in your standard Form 1040 or consult your tax professional.

Filing: Make sure to attach Form 5695 with your tax filing to accurately claim the heat pump tax credit.

For more comprehensive guidance on filling out the form, please read the IRS’s Official Guide Here. If you require further information, you can use the form below to reach us.

UniColorado Heating & Cooling thanks you for being a valued customer. Your support is pivotal to our success, and in return, we are committed to assisting you before, during, and after your Climate-Friendly Home Upgrade.