Locally Owned & Operated

5-Star Rated

- HeatingHeating GuidesAbout

-

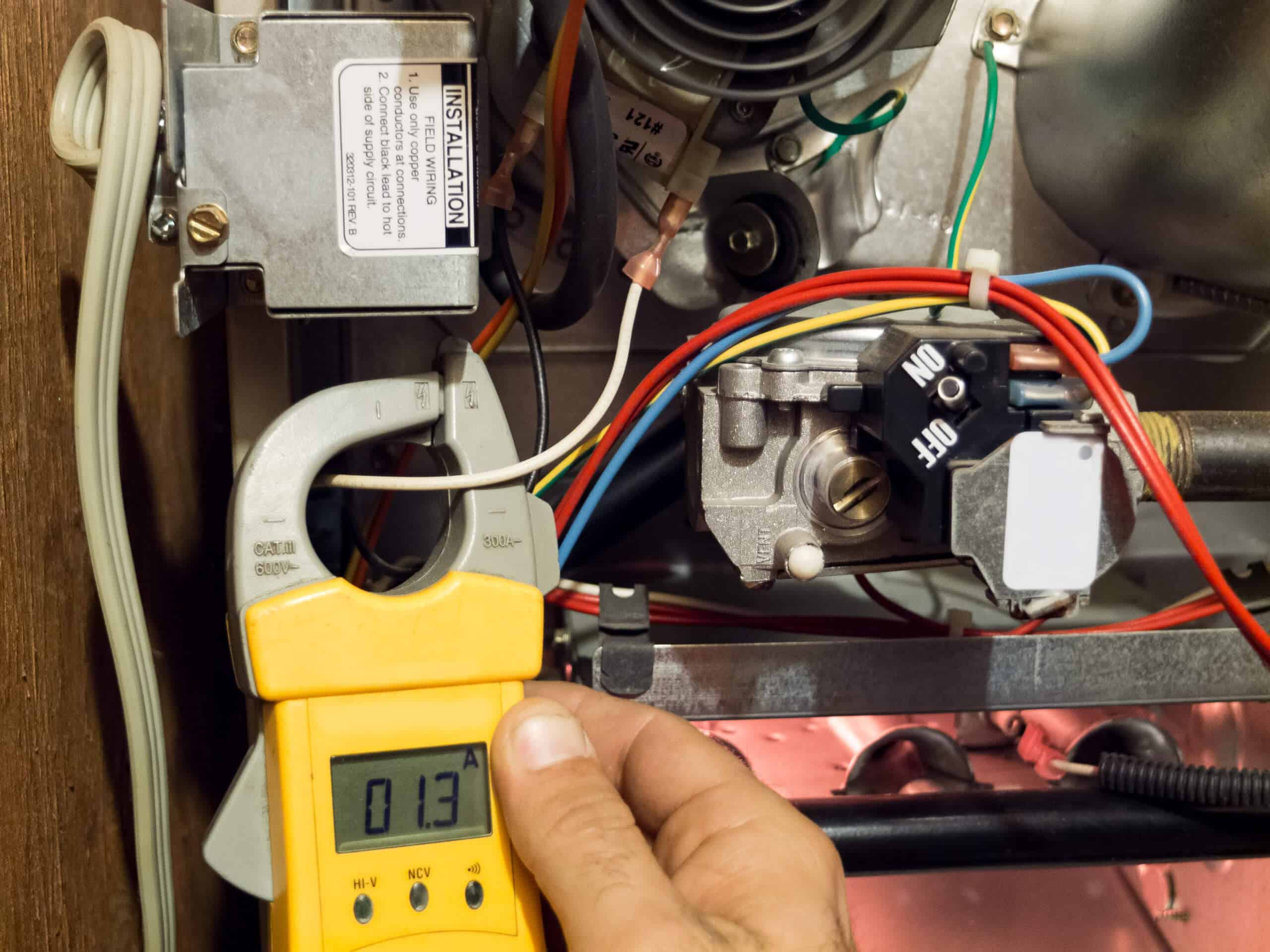

All brands & models of furnaces

-

Denver metro + adjacent cities

-

Certified technicians

-

Emergency repairs & installations

-

- Air ConditioningAC GuidesAbout

-

All brands & models of central AC

-

Denver metro + adjacent cities

-

Certified technicians

-

Emergency repairs & installations

-

- Heat PumpHeat Pump GuidesRebates & Incentives

- ElectricalElectrical Guides (coming soon)

- AboutAbout UsAbout UniColoradoUniColorado is a heating, air conditioning and electrification contractor serving residential customers in the Denver metro area, including Centennial, Littleton, Highlands Ranch and more.

Operating Hours

Operating HoursMonday to Friday: 7AM - 7PM

Saturday & Sunday : 9AM-1PM